Features

Operations

landing on the numbers

Boasting more than 400 companies, Canada’s aerospace industry employs approximately 80,000 people and generates annual sales in excess of $20 billion.

January 10, 2011 By Frederick K. Larkin

Boasting more than 400 companies, Canada’s aerospace industry employs approximately 80,000 people and generates annual sales in excess of $20 billion. The fact that roughly 80 per cent of its output is exported is a testament to its ingenuity. Be they airframes, engines, simulation systems or sophisticated components, Canadian-designed and -manufactured goods make the global aviation business fly.

|

|

| Bombardier is banking on its new long-range Global 7000 to set a benchmark in the large business jet market. PHOTO: Bombardier |

Given the economic turmoil experienced during the past two years, it’s timely to explore the current market to see what opportunities may lie in store. But before highlighting some of Canada’s most prominent aerospace firms and their prospects for the next few months, it’s pertinent to review the current economic environment – and its impact on the aerospace industry.

A vision shared by many economic forecasters and stock market prognosticators maintains that the global economy is transitioning to a slower pace of growth. This is partly due to the reduced rate of inventory restocking that has been underway since the financial meltdown in late 2008.

As government stimulus programs (including support for the automotive and housing industries, as well as infrastructure development) are throttled back, it remains to be seen if the consumer and private industry can pick up the slack. With higher income taxes being considered by certain industrialized countries, growth may be difficult to achieve.

There is some good news, however. The BRIC countries (Brazil, Russia, India and China) are expected to continue to achieve improved economic performance in the months ahead. As a result, their demand for a wide range of commodities is expected to remain firm. It follows that with increased standards of living, these four nations and others in their geographic regions will witness an expansion in air travel related to business and pleasure – and their need for aerospace products will subsequently increase.

Given its wealth of natural resources and relatively stable financial industry, Canada should experience economic growth during 2011. Having said that, however, few are expecting a robust performance as worries associated with the U.S. housing industry, its tax regulations, and concerns about future inflation resulting from its government’s spending/debt levels and monetary policy, are dampening expectations.

To gain some insight into what may be expected of the Canadian aerospace industry, Wings chronicled the prospects of five leading Canadian aerospace companies representing airframe, power plant, simulation equipment and aerostructure/component manufacturers. Regardless of their size, each company is actively involved in the process of developing new products or preparing to participate in the production of new products. Here’s a snapshot of how they will fare in the months and years to come – and where opportunities will emerge going forward.

BOMBARDIER AEROSPACE, Dorval, Que.

Bombardier is the world’s third largest manufacturer of aircraft and is the leading producer of regional airliners and corporate jets. During its most recent fiscal year, 93 per cent of its $9 billion in aerospace sales came from outside Canada.

The Commercial Aircraft division currently manufactures three regional jets: the 66- to 78-seat CRJ700; the 77- to 90-seat CRJ900; and the new 93- to 100-seat CRJ1000 in Mirabel, Que. It also produces the 70- to 80-seat Q400 turboprop in Toronto.

The Business Aircraft division currently produces three families of jets that fit into the light, medium and heavy categories, respectively: the Learjet 40XR, 45XR and 60XR in Wichita, Kan; the Challenger 300, 605 and 850 in Dorval; and the Global 5000 and Global Express XRS in Toronto.

The forecast

Commercial aircraft – The most exciting opportunity within the global commercial aircraft market in the next few years will be developing an aircraft that can meet the requirements of mainline and low-cost carriers for a more efficient 100- to 145-seat airplane than what is currently available.

|

|

A clean sheet design incorporating a more efficient airfoil, a new airframe built with advanced structural materials and a next-generation power plant would theoretically present the optimum solution to make an impact in this market segment. And that’s precisely where Bombardier’s new CSeries comes in. The new family of airliners has been designed to provide a 15 per cent direct operating cost advantage; produce a 20 per cent reduction in fuel consumption; offer a significantly smaller noise footprint, being four times quieter; and produce a range of 2,000 to 3,400 miles.

Real potential exists for Bombardier in various markets for the two members of the CSeries family – the CS100 (100 to 125 seats) and the CS300 (120 to 145-seats). Their Pratt & Whitney PW1524G engines are scheduled to be certified in 2012 enabling the two aircraft to enter service in 2013 and 2014, respectively.

Despite the unsettled economic environment, and potential competition from re-engined versions of the Boeing 737-600/700 and Airbus A318/319 models, Bombardier has managed to receive orders for 33 CS100s and 57 CS300s.

Business aircraft – The health of the economy dictates there will be a steady demand for corporate air travel in the months and years ahead. Wealth creation, as measured by corporate earnings and in turn by the value of leading stock market indices, is another determinant of business aircraft demand.

Having suffered a significant downturn during the latter half of 2008 and throughout 2009, the global business aviation industry is experiencing a gradual recovery. This is supported by the facts that aircraft utilization rates are improving; the secondary market has strengthened and inventories of pre-owned aircraft have declined; and new orders have increased while order cancellations have slowed, resulting in net new orders in recent quarters. The strongest order backlogs among Bombardier’s corporate aircraft are with its largest, and most expensive, models.

Bombardier forecasts that over the next 20 years, approximately 26,000 business jets with a value of $660 billion will be delivered worldwide. That would increase the fleet from the 14,200 units that existed in 2009 to 29,000 by 2029. Included in that figure are 11,200 expected retirements.

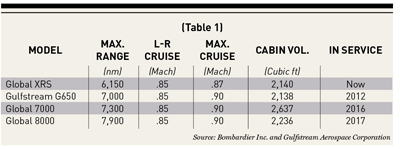

The fastest-growing segment of the bizjet market is forecast to be at the top end. The owners/operators of large corporate jets have expressed what they wish to see in a next-generation airplane: greater range, higher cruise speed and a larger cabin. Bombardier is developing two models, the Global 7000 and the Global 8000, to address this expanding market. Table 1 compares those new models with Bombardier’s current flagship (the Global Express XRS) and that of its chief competitor (the new Gulfstream G650) using the key metrics of range, speed and cabin size.

While the Global 7000 and 8000 will fill the larger business-jet void, Bombardier is also going large with its Learjet 85 – the largest variant of that venerable family. It is being designed to fly four passengers 3,000 nautical miles at M.78, or up to nine passengers on shorter missions at M.82. When it enters service in 2013, it will have been 50 years since the first flight of the pioneering Learjet 23.

Bombardier president and CEO Pierre Beaudoin is cautiously optimistic when commenting on the company’s fortunes going forward. “The environment in aerospace remains difficult with leading indicators sending mixed signals as to the timing of a full recovery,” Beaudoin says. “Nevertheless, we continue to work on our development programs and announced, in September, the launch of the Global 7000 and Global 8000 jets.

“As the global economy firms up, our product strategy will position us well to expand our market share as well as to increase our penetration of emerging markets.”

PRATT & WHITNEY CANADA, Longueuil, Que.

P&WC is a leading manufacturer of small turbine engines for the aerospace industry and produces 13 families of engines for both fixed- and rotary-wing aircraft.

Outlook – Given its exposure to the general aviation and regional airline industries around the world, P&WC is expected to participate in the rebound in demand for aircraft as the global economy recovers. Evidence of this is provided with the following recent developments:

- In mid-December, P&WC announced it is investing $1 billion to develop lighter aircraft engines with increased power, greater fuel capacity and better durability. The project is expected to create more than 2,700 jobs over 15 years. The federal government is contributing some $300 million to the project in a “repayable investment.”

- NetJets announced at the NBAA show in Atlanta, Ga., that it has ordered 50 Embraer EMB-505 Phenom 300s, with options on another 75. This could mean as many as 250 PW500 engines with that order.

- The new PW210 turboshaft, already chosen for the new Sikorsky S-76D currently under development, has been selected to power the new AgustaWestland AW169.

- The PW300 will be on the Learjet 85 that is due to fly in 2012.

Another key indicator of Pratt & Whitney’s future prosperity is its demand for human resources. In November, P&WC announced it was recruiting 200 engineers to support development programs at its plants in Longueuil, Que., and Mississauga, Ont.

|

|

| CAE produces full-flight simulators for new aircraft, including the Boeing 747-8 and 787 models. PHOTO: cae |

CAE, Saint-Laurent, Que.

CAE designs and manufactures flight simulation equipment and provides flight training services for civil and military customers. Since its inception in 1947, CAE has delivered more than 1,000 full-flight simulators (FFSs) and flight training devices (FTDs) to more than 130 airlines, airframe original equipment manufacturers (OEMs) and training organizations around the world. The company has captured more than 70 per cent of the global FFS market in recent years, and fortunes are on the upswing.

CAE is also a major player in the flight training business, with more than 140 FFSs in 24 centres worldwide. Its 3,500 customers include airlines, corporations and aircraft OEMs.

On the military front, CAE is one of the world’s leading suppliers of full-mission simulators. The company also provides simulation instruction and maintenance at more than 60 locations worldwide.

Outlook: Civil – Over the past two decades, global passenger traffic has had a Compound Annual Growth Rate (CAGR) of about five per cent. The leading airframe OEMs are looking for similar growth over the next 20 years, with the strongest prospects coming from China, India and the Middle East. This bodes well for new airliner deliveries and for FFS demand. Typically one FFS is required for every 30-35 narrow-body airliners within a given airline’s fleet. The ratio is one for every 15 to 20 wide-body airliners.

CAE’s technical leadership has resulted in it being the first company to provide FFSs for new aircraft, such as the Airbus A380 and A350, the Mitsubishi Regional Jet, the ATR42-600 and ATR72-600, and the Bombardier CSeries and Learjet 85. It has also produced FFSs for other new aircraft including the Boeing 747-8 and 787 models, Embraer’s 190 and Phenom 100/300 models, as well as the COMAC ARJ21.

Several current trends should result in opportunities for CAE’s civil businesses. For example, new orders for existing airliner and business aircraft models and the introduction of new airliner and business aircraft models, will produce favourable circumstances for the company. Increased travel demand on the business and leisure side of the ledger from emerging economies will also drive sales, as will the long-term demand for qualified aircrew as the population of pilots declines with retirements and the number of aircraft in service increases.

Military – During the past two years, CAE has received more than $2 billion worth of orders from defence forces. The company forecasts that over the next five years, approximately 9,500 new military aircraft will enter service, thereby requiring some 300 full-mission simulators. The key drivers behind the continuing growth of CAE’s military business include:

- budget-related pressures that will require governments to “do more with less” within their armed forces. Sophisticated simulation provides an extremely cost-effective alternative to training with actual assets.

- risks to personnel in live training are also reduced through the use of simulators.

- the evolving nature of warfare that uses land, sea and air forces, not to mention multi-national teams, will require mission rehearsal capabilities in the company’s training programs.

CAE’s book-to-bill ratio during the 12 months ended September 30, 2010, was 1.18x, resulting in an order backlog of approximately $3.2 billion. That represents twice the revenues of its most recent fiscal year.

Said president and CEO Marc Parent of his firm’s solid third quarter results: “Our performance in the second quarter showed more evidence of the recovery underway in commercial aviation with higher utilization of our training centres and increased orders for our simulation products. Government cost-cutting will present new challenges to the defence industry; however, we expect CAE to continue to grow by helping our customers maintain readiness at a lower cost through simulation-based training.”

Civil and military customers rely on CAE’s products and services to optimize the performance of their substantial asset bases. As long as there is continuing improvement in the global standard of living, and as long as world peace continues to be threatened, CAE’s standing as a leader in the Canadian aerospace industry will remain strong.

MAGELLAN AEROSPACE, Mississauga, Ont.

With operations in Canada, the United States and the United Kingdom, Magellan designs, engineers and manufactures aero engine and aerostructures used in commercial and military aircraft and in spacecraft. The company also serves the aftermarket by supplying spare parts and providing repair and overhaul services. Its core capabilities include the manufacture of composite structures and engine components; precision magnesium aluminum castings for turbine engines; jet engine components used on commercial and military aircraft; jet engine nacelles and exhaust systems; and rocket systems and satellites.

During 2009, approximately 15 per cent of its $687 million in sales were from Airbus and about 11 per cent came from Boeing.

Outlook – Magellan is participating in three high-profile aircraft development projects that promise to provide increased revenues as production rates build over the next decade.

The Boeing 787 program has been unexpectedly challenged in recent months and is behind schedule. Nonetheless, the order book for this new family of airliners remains strong. Through the end of October last year, there were 847 ordered, including 629 for the 787-8 and 218 for the stretched 787-9. Magellan will be supplying assemblies for the 787’s nose and main landing gear.

The Airbus A350 program has also had its issues and is now anticipating its first flight in 2012. But again, given its attractive economics, this family has generated interest from the global airline industry. As of the end of October 2010, there were 573 ordered, including 168 for the shorter A350-800, 285 for the standard A350-900 and 75 for the stretched A350-1000.

These three variants are due to enter service in 2014, 2013 and 2015, respectively. Magellan will also be producing a number of large, complex machined aluminum-lithium components for the A350’s centre wing box. Work is due to begin in 2012 on an initial batch of 400 shipsets.

The federal government’s $9 billion deal to purchase 65 Lockheed Martin F-35 Lightning II aircraft looms large in Magellan’s future. The company estimates that its deliveries of F-35 airframe and engine components could reach US$3 billion over 25-30 years, with revenues as high as US$120 million annually once the full rate of production is realized. For example, 1,038 shipsets of horizontal stabilizers are expected to be produced by Magellan over the life of the program.

Magellan also has a six-year $60 million contract to supply complex machined titanium components for the fifth-generation fighter.

Jim Butyniec, president and CEO of Magellan, maintains prospects for the future look bright, especially on the civil airline and military fronts. “The civil airline business has improved dramatically during 2010, achieving high load factors, and operating profitably. This enables the airlines to add new, more efficient aircraft to their fleets, and that translates into more manufacturing volume for Magellan,” he says. “In the defence sector, the F-35 aircraft continues to progress and higher volumes are contracted each year en route to entry into full-scale production in five or six years. Magellan has a strong presence in both structure and engine parts and assembly, and is excited about the outlook for this aircraft.”

|

|

| Heroux-Devtek supplies landing gear for both the commercial and military markets. PHOTO: Bombardier |

HEROUX-DEVTEK, Longueuil, Que.

Heroux-Devtek’s aerospace business represents 90 per cent of its annual sales. Serving OEMs and the aftermarket with landing gear components and out-of-production aircraft parts, Heroux-Devtek supplies both commercial and military markets. Its largest customers (each representing more than 10 per cent of its total sales) include Bombardier Aerospace, Goodrich, Lockheed Martin, the U.S. air force and the U.S. navy. Approximately 70 per cent of its sales are exported.

The company participates in a number of programs with both fixed- and rotary-wing customers from Bell, Boeing, Bombardier, Embraer, Gulfstream and Lockheed Martin.

Outlook – Airbus has announced it will be increasing the production rate for its A318/319/320/321 family from 34 to 36 units per month starting in December 2010, while Boeing plans to increase the production rate on its 737-600/700/800/900ER family from 31.5 units to 34 units per month in early 2012. Though not significant increases, they do reflect a more optimistic view of the future than what was expected a year ago.

Heroux-Devtek has exposure to both of these landmark commercial programs. Recently further expansion into the commercial market came with the news that the company has been awarded a contract by Dassault Aviation to provide the landing gear on a new business jet program.

“This fourth design and development contract won since 2007, and the third in the business jet category, reinforces our reputation in this market,” confirms Heroux-Devtek president Gilles Labbe.

On the military side, Heroux-Devtek has received orders for as much as $220 million of work on the F-35 aircraft. In recent months, it has also received contracts worth more than $32 million to supply landing gear components for numerous aircraft types operated by the U.S. air force and the U.S. navy.

Heroux-Devtek’s order backlog at Sept. 30, 2010, stood at $574 million, up 35 per cent per from where it stood six months earlier. To put that into perspective, the company has annual sales of approximately $320 million.

Given its exposure to both mature and new aircraft programs in commercial and military markets, Heroux-Devtek is expected to achieve continued growth going forward.

Forward progress With the global airline industry back in the black, carriers will be modernizing their fleets to handle more traffic and enhance productivity. While corporate aviation’s recovery will lag that of the economy, it should experience growth as developing nations recognize the importance of airborne time machines.

Defence budgets of major nations will receive greater scrutiny, given the financial distress that many governments are experiencing. Nonetheless, transports and helicopters seem unlikely candidates for cutbacks given their strategic roles.

A continuing strong Canadian dollar would moderate profit margins of domestic manufacturers, as most of the industry’s output is priced in the U.S. currency. A positive offset to this is it's more affordable for Canadian companies to upgrade their production technology and enhance their competitiveness.

All this would seem to augur well for the “home team.” In its recent review of the Canadian aerospace industry, the Conference Board of Canada noted, “As order books gradually expand and inventories of existing aircraft are sold, the pace of production will increase. By 2014, production is expected to surpass its pre-recession peak, making it an exception among industries within Canada’s manufacturing sector.”

Roger that!

| Ones to watch Four dynamic Canadian aerospace firms trending upwards While they may be smaller than their major competitors in their respective areas of expertise, these Canadian firms are poised for growth by developing innovative products that satisfy the needs of their respective markets. As the global aviation industry rebounds, their stock should continue to rise.

|