News

JETNET notes market trends for BizAv, Heli markets

Feb. 1, 2011, Utica, N.Y. - JETNET LLC has released December 2010 results for the pre-owned business jet, business turboprop, and helicopter markets.

February 1, 2011 By Carey Fredericks

New aircraft orders are based on the successful sale of existing aircraft in the pre-owned market, a good first

predictor. 2010 brought welcome good news—Pre-owned Full Sale Business Jet Transactions for the year

improved by 16 per cent compared to 2009, and exceeded the 2008 transaction level by 4.8 per cent.

Market Summary

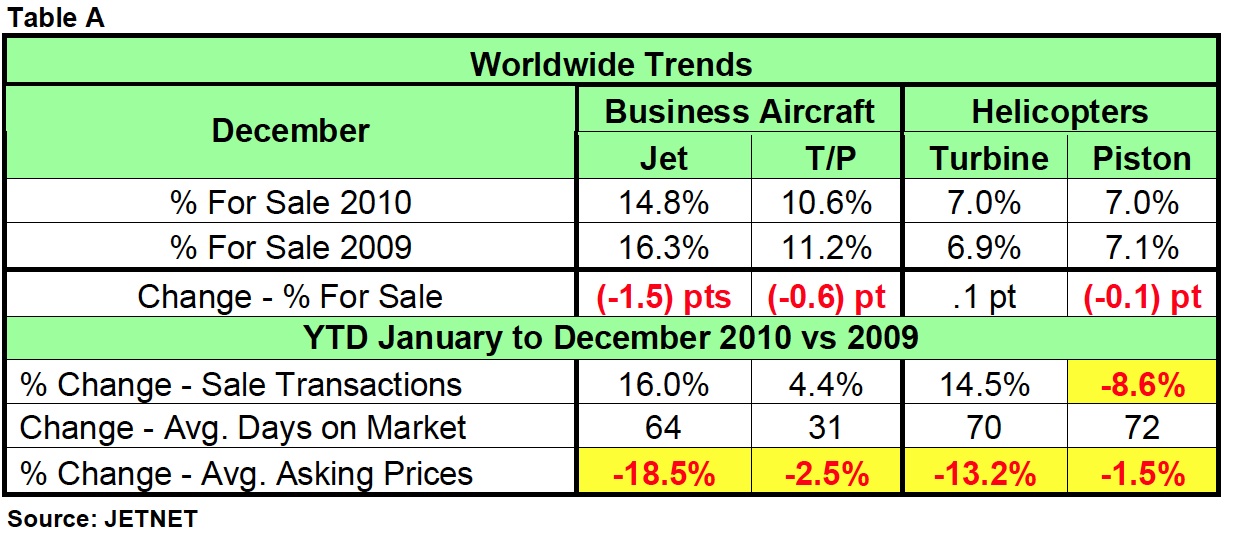

Table A highlights the key worldwide trends across all aircraft market segments, comparing 2010 to 2009.

Business Jet Inventory For Sale percentage shows the largest change, down 1.5 points, from 16.3 per cent to 14.8 per cent. Most important is the percentage change in Sale Transactions. Business Jets lead with the largest percentage gain, 16 per cent, compared to 2009. All business and helicopter aircraft categories took longer to sell in 2010, ranging from 31 to 72 more days in the year-over-year (YOY) comparisons.

All pre-owned aircraft categories show a decrease in the average asking price, ranging from a low of -1.5 per cent for piston helicopters to -18.5 per cent for business jets. The Pre-owned Piston Helicopter segment is the only sector down in sale transactions (a 8.6 per cent drop) in 2010 compared to 2009.

|

|

|

|

Pre-owned Business Jet Aircraft For Sale

|

|

|

|

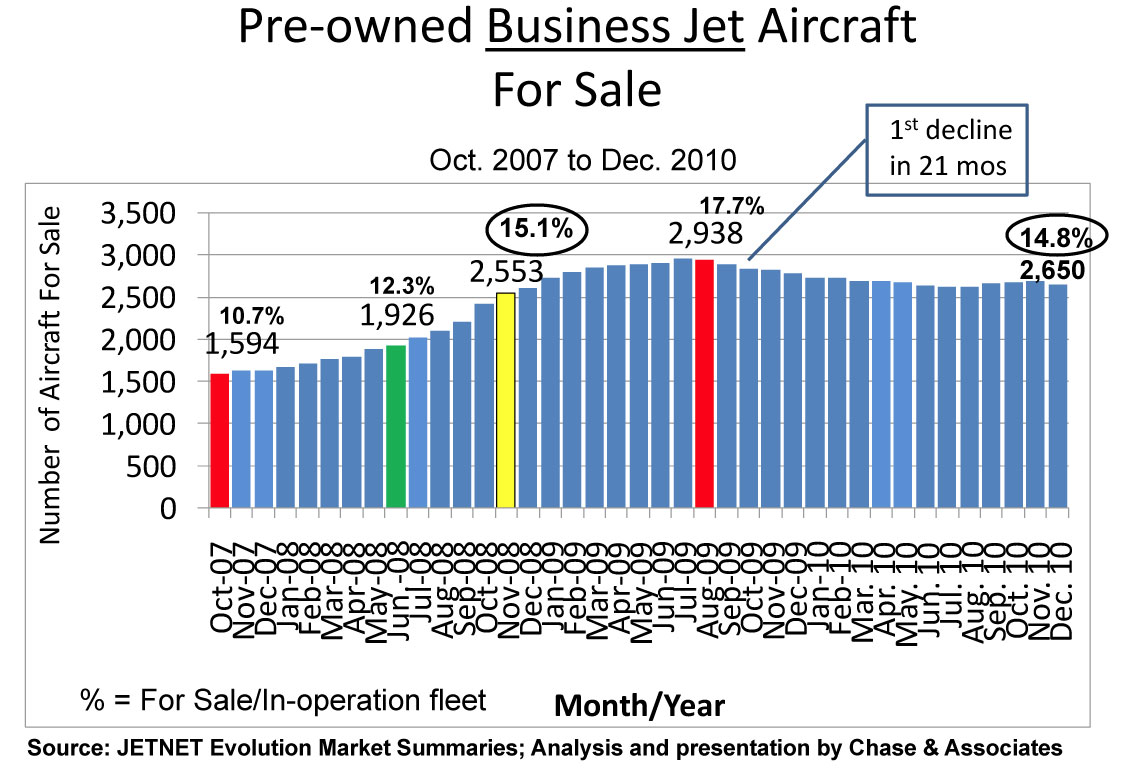

Chart A illustrates the build-up in Business Jet For Sale inventory, which increased for 21 months, from 10.7 per cent in October 2007 to 17.7 per cent in August 2009. The percentage of jets for sale then slowly dropped for 16 months to 14.8 per cent in December 2010. So we still remain in a buyer’s market, with business jets showing percentages greater than 10 per cent for sale. A seller’s market is when 10 per cent or less of the pre-owned business jets are for sale.

Looking back, the sharp reality is that in March 2008, YOY Pre-owned Full Sale Business Jet Transactions started to decline. That trend has continued along with a huge build-up of aircraft for sale. We expected the “average days on market” numbers to rise with the increase in inventories, and they have. We expected dealers to drop their prices in reaction to this cycle, and they have. This trend is a typical indicator of a downward cycle.

So what were the underlying causes?

The difficult financial credit climate, coupled with the bubble in 2008 of higher fuel prices, no doubt reduced

demand and reversed the run-up of higher aircraft values of prior years. The good news is that in 2010 the

business jet industry overcame the downward trend witnessed in late 2008 and 2009. There was a YOY

Pre-owned Business Jet Transactions increase of 16 per cent from 2009 to 2010, and of 4.8 per cent from 2008 to 2010.

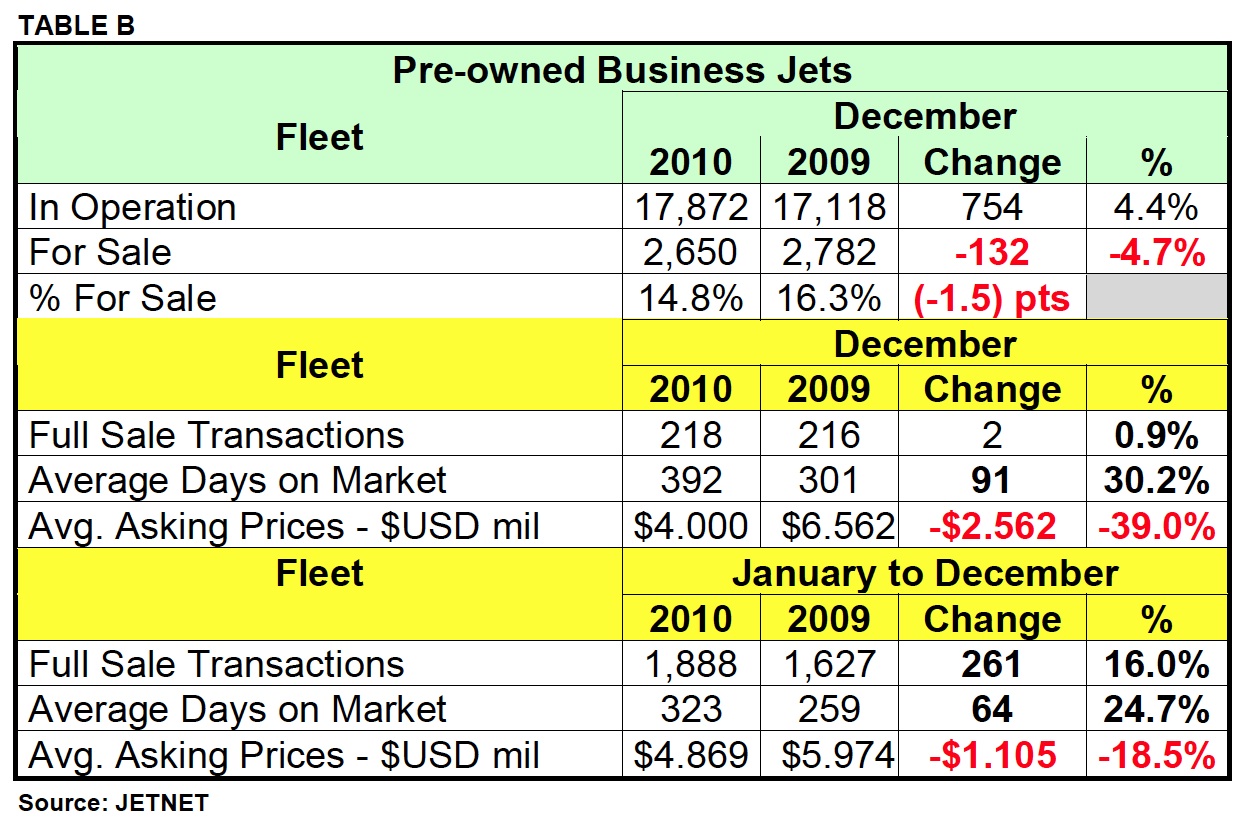

Pre-owned Business Jets For Sale and Full Sale Transactions

|

|

|

|

Other recent industry metrics reveal a mixed picture. The current average number of days that a pre-owned

business aircraft remains on the market is 323 days, or 64 days more in 2010 than 2009. Also, the average

asking price in 2010 fell by 18.5 per cent compared to 2009, resulting in a very good climate for buying a business jet.

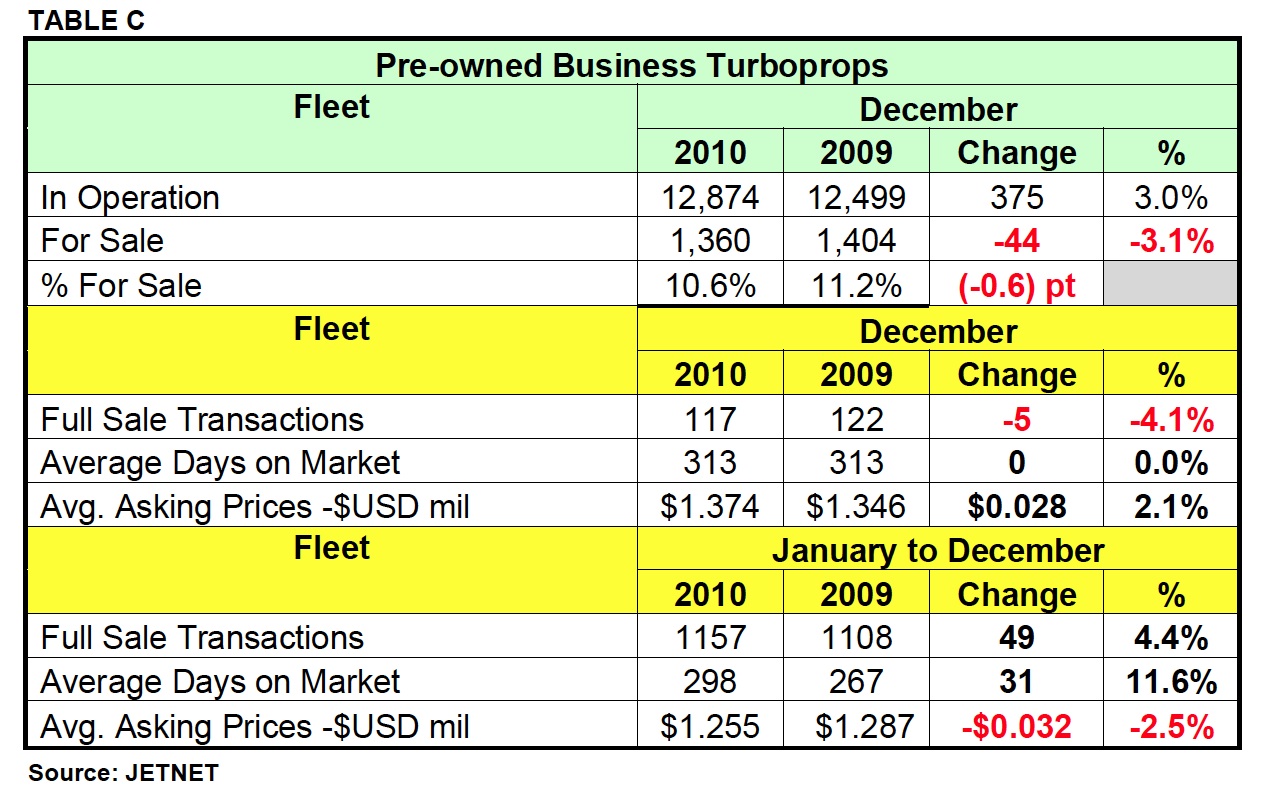

Business Turboprop Aircraft

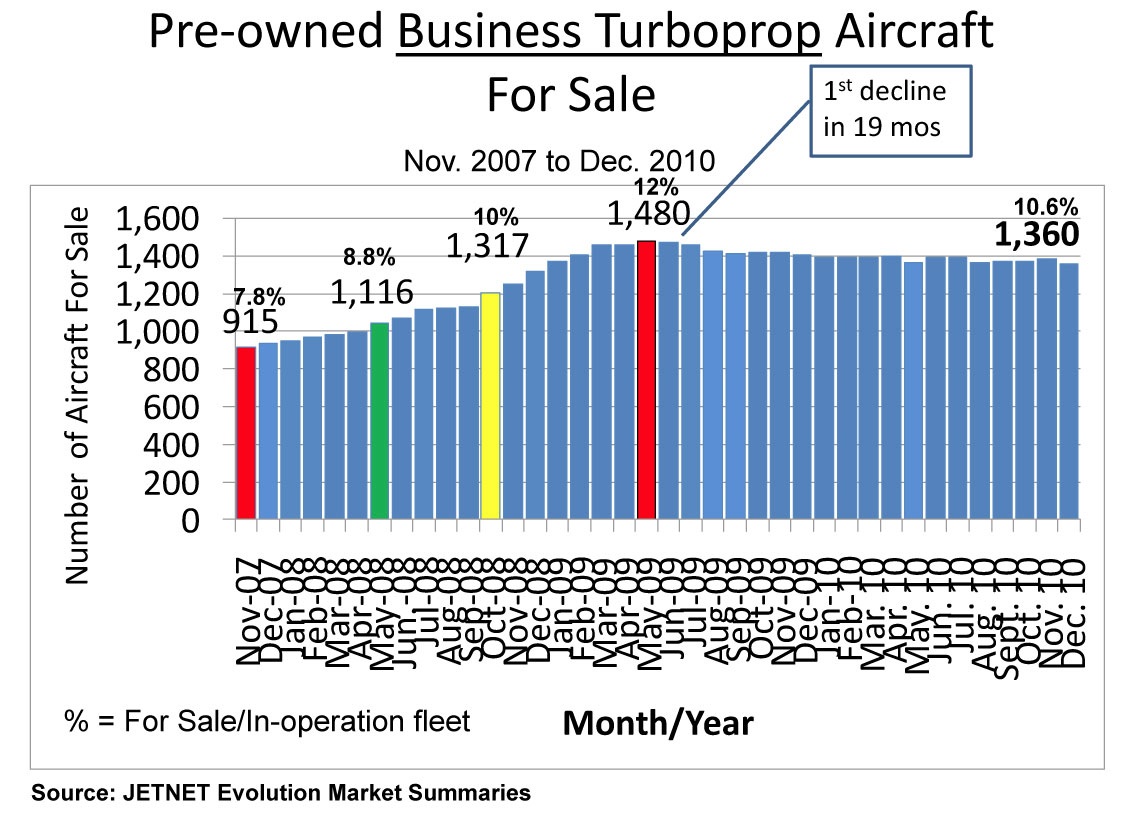

The inventory levels for pre-owned business turboprop aircraft for sale at the end of 2010 followed the same

pattern as the business jet aircraft market. The percentage of pre-owned business turboprop aircraft for sale was 10.5 per cent in December 2010, and has declined from the peak of 12.0 per cent set in both May and June 2009. The number of business turboprops for sale at the end of June 2010 was slightly less than 1,400 aircraft, nearly half the number of business jets currently for sale.

Pre-owned Business Turboprop Aircraft For Sale

|

|

|

|

Pre-owned Business Turboprops

|

|

|

|

The number of pre-owned full sale transactions for business turboprop aircraft increased by 4.4 per cent in 2010

compared to the same period in 2009, which is good news.

However, it is taking longer (more days) to sell in the current market environment. The average days on the

market before business turboprop aircraft sold was 298 days for 2010, an increase of 11.6 per cent, or 31 more days compared to the same period in 2009. Additionally, the average asking price decreased by 2.5 per cent in 2010 compared to the same period in 2009.

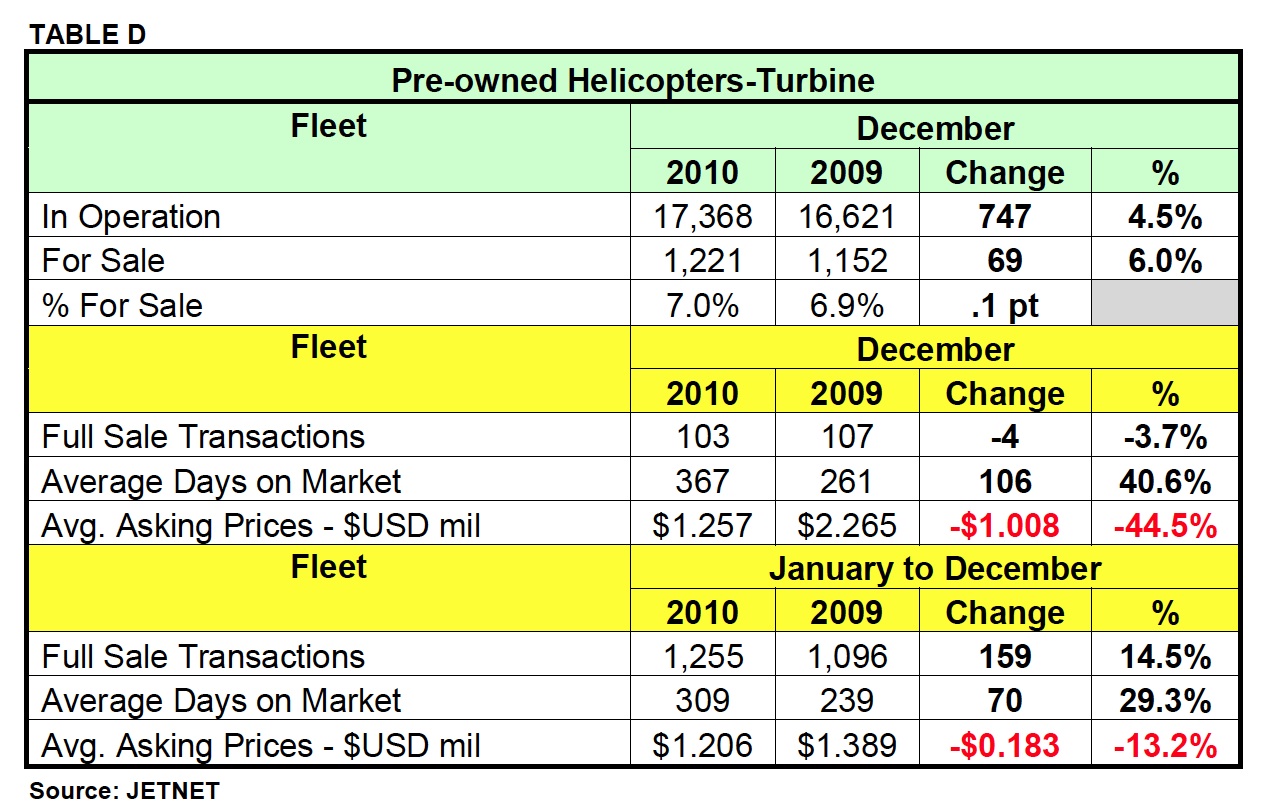

Helicopters – Turbine (excludes Civil Russian manufactured helicopters)

The number of pre-owned turbine helicopters for sale in December 2010 was slightly more than 1,200 helicopters, or 139 less than the business turboprop market. The percentage for sale of 7.0 per cent in 2010 (a buyer’s market) was higher than the 6.9 per cent level of 2009. A buyer’s market in the helicopter world is when the percentage of helicopters for sale exceeds 5 per cent of the fleet.

|

|

|

|

The number of pre-owned full sale transactions for turbine helicopters increased by 14.5 per cent in 2010 compared to 2009. Again, this improvement in sales is excellent news for the turbine helicopter industry.

The average days on the market for turbine helicopters was 309 days, or 70 days more in 2010 compared to 2009. However, the average asking price fell by 13.2 per cent in 2010 compared to 2009.

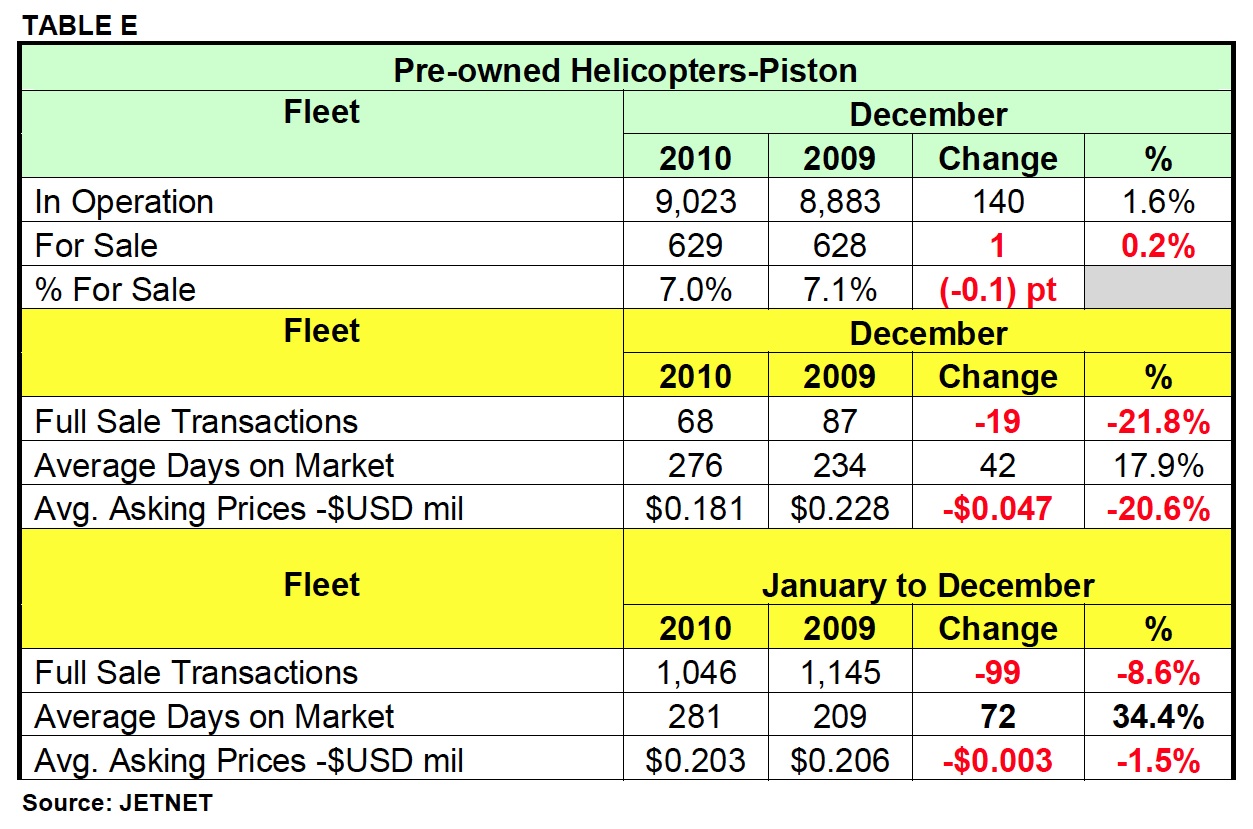

Helicopters – Piston (excludes Russian manufactured helicopters)

The number of pre-owned piston helicopters for sale in December 2010 was 629 helicopters, or nearly half the number of turbine helicopters. The percentage for sale of 7.0 per cent (a buyer’s market) was only slightly below the 7.1 per cent level from the same period of 2009.

|

|

|

|

The number of pre-owned full sale transactions for piston helicopters decreased by 8.6 per cent in 2010 compared to 2009. The average days on the market for piston helicopters was 281 days, or 72 days more in 2010 compared 2009. However, the average asking price for piston helicopters fell by 1.5 per cent in 2010 compared to 2009.

The reality is the current business down cycle will last longer than the industry would like. The good news is that the business aircraft and helicopter markets are on the right track.