News

Working with Ornge to stay in the black

Northern Ontario represents approximately 87 per cent of the province’s land area, but only about six per cent of its population.

October 31, 2012 By Frederick K. Larkin

Northern Ontario represents approximately 87 per cent of the province’s land area, but only about six per cent of its population. That uneven distribution results in the need for emergency air transportation to connect its citizens in remote locations with the sophisticated health facilities in the south.

|

|

| The workhorse of Air Bravo’s air ambulance operation is the Pilatus PC-12/45. Photo: Air Bravo

|

The Ontario government’s provision of air ambulance services began in October 1977 with a Bell 212 operated by Toronto Helicopters from Toronto Buttonville Municipal Airport in Markham. It was joined by another Bell 212 in 1980. In the meantime, the first dedicated fixed-wing ambulance had entered service when Austin Airways based a Cessna Citation I at Timmins in October 1978. During the following quarter century, the air ambulance network in Ontario grew into a fleet of almost 90 aircraft operated by numerous private firms.

Ontario’s Ambulance Act states that the province’s Minister of Health and Long-Term Care (MOH) “has the duty and the power to fund and ensure the provision of air ambulance services.” While the MOH had relied upon private-sector participants to provide aircraft, flight crew and paramedics to support its air ambulance program that was to change.

On Oct. 8, 2004, the MOH established the Ontario Air Ambulance Services Co. (OAASC). The ostensibly not-for-profit company was tasked to oversee all air ambulance operations within Ontario. That included contracting of flight service providers, oversight of all paramedics, dispatch and authorization of air ambulance transfers. OAASC inherited the contracts that the MOH had in place with 20 aircraft operators on Jan. 3, 2006. It was renamed Ornge in August of that year.

In June 2007, Ornge issued a request for information (RFI) to all its aviation partners. It asked each of them to provide operational and financial details related to their air ambulance businesses. Three months later, after the RFI had closed, Ornge announced that it would be establishing its own air ambulance business. On Sept. 17, 2007, 4384865 Canada Inc. (operating as Ornge Air) was created. Using rotary-wing and fixed-wing aircraft, it would compete with the private-sector providers.

On Aug. 25, 2008, Ornge announced its plan to acquire 12 AgustaWestland AW139 helicopters for U.S. $148 million. These would replace the Sikorsky S-76As operated by Canadian Helicopters Limited (CHL). The second shoe dropped soon after, when on Oct. 7, Ornge ordered 10 Pilatus PC-12/47E turboprops for U.S.$42 million.

|

|

| Air Bravo is currently getting approximately 130 hours per month on each of its PC-12s, down from 200 hours per month prior to the introduction of the Ornge Air fleet.

|

On March 31, 2009, Ornge purchased 11 S-76As for $28 million and four hangars (in Kenora, London, Moosonee and Ottawa) for $2 million from CHL. The helicopter upgrade was accomplished with the delivery of 10 AW139s between June 2010 and May 2011. The last two arrived in May 2012 and were put up for sale. The PC-12s were delivered between March 2009 and January 2011. On March 31, 2012, CHL’s contract with Ornge expired and the flight operations were henceforth conducted by Ornge Air personnel.

In late 2011, allegations of improper behaviour were made against senior Ornge officers and the MOH took control of the company in January 2012. Its CEO was replaced, as was its board of directors, and a team of forensic auditors was sent in to investigate the activities and finances of the state-sponsored enterprise.

In addition to operating its own aircraft, Ornge currently contracts with five Standing Agreement carriers to transport patients throughout the province. The largest of those is Air Bravo Corporation of Blind River, Ont. Beginning in 2001 with a single piston-powered aircraft, the company has weathered the turbulence within the Ontario air ambulance industry and today operates a fleet of 10 turboprops. Can this feisty independent remain healthy going forward or will it succumb to the maladies that have plagued other air ambulance carriers? Before attempting to answer that, it is useful to examine where the company has come from.

That was then . . .

Back at the turn of the century, Rick Horwath was splitting his time between two employers. During the summers he flew the deHavilland Beaver and the Cessna 206 of Timber Wolf Air, the air charter arm of Louie’s Outposts – his family’s wilderness vacation outfit in Blind River, Ont. For the rest of the year, he flew the ambulance configured Rockwell Commander 700s of Air Muskoka out of Bracebridge, Ont. At the time, Horwath’s eye doctor was Paul Monk in nearby Gravenhurst. Dr. Monk flew his own Cessna 421B Golden Eagle to visit patients in remote northern communities. The two agreed that an opportunity existed to start up an air ambulance service and thus became 50/50 owners of a new venture named Air Bravo.

Given Rick Horwath’s familiarity with the Rockwell Commander 700, it made sense that the type was selected for their operation. Developed as the Fuji FA-300 in Japan, the Commander 700 had a large pressurized cabin that was ideal for medevac missions. Powered by two 340HP Lycomings, it cruised at 200 miles per hour with two patients, two paramedics and a pair of pilots aboard. Air Bravo’s first aircraft was registered in December 2001 and its first revenue flight took off on New Year’s Day 2002 from its base at Elliot Lake, Ont. The fledgling outfit’s second aircraft, another Commander 700, arrived at CYEL nine months later in September.

While the first year of operations had seen almost all of its revenues realized from medevac missions, by the spring of 2003, the revenue mix had shifted to 85 per cent medical/15 per cent charter. Demand for corporate and leisure charters was increasing and that led the two entrepreneurs to consider adding a third aircraft. In May 2003, a Pilatus PC-12/45 was leased from V. Kelner Pilatus Centre and was based at Thunder Bay, Ont. The single-engine turboprop was able to transport two patients, and a pair of paramedics further and faster than the Commander 700s. It could also carry up to nine passengers or as much as 2,800 pounds of cargo as a freighter. At the time, Air Bravo employed 22 – 10 pilots, eight paramedics and four administrative staff.

During the following two years, the company remained viable, but experienced little growth. In 2004, Horwath bought out Dr. Monk and became Air Bravo’s sole shareholder. Activity picked up again the following year and the company added two more PC-12s to the fleet in February and October of 2005. Two additional PC-12s joined the operation in April and August of 2007.

NAC Air, a Thunder Bay-based operator of seven PC-12s, shut down in January 2008. Air Bravo used that event as an opportunity to further expand and proceeded to add three more of the Swiss singles in March, April and June of that year. The company had doubled the size of its fleet from five to 10 aircraft in the 14 months between April 2007 and June 2008.

This is now . . .

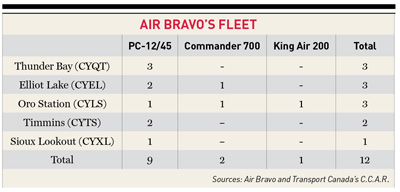

Today, Air Bravo operates a dozen aircraft from five bases as shown in the accompanying table.

|

|

The PC-12s perform the air ambulance missions, as well as charters. The two Commander 700s no longer fly medevacs and are primarily used for logistical support purposes. The King Air 200 is managed for CREEWESTair of Moose Factory and is used for charter work.

The company had a base at Billy Bishop Toronto City Airport (CYTZ) for a number of years. Due to increased congestion at that urban hub, in October 2011 it moved the base north 60 miles to Lake Simcoe Regional Airport – located halfway between Barrie and Orillia at Oro Station.

Air Bravo is an Approved Maintenance Organization (AMO), certified by Transport Canada. Its facilities provide 24-hour daily routine line maintenance, heavy maintenance and perform structural repairs.

The competitive environment

A significant portion of Air Bravo’s current revenues comes from flying for Ornge. The government sponsored entity is not only the company’s largest customer, but also its major competitor –equipped with a slightly larger fleet of similar aircraft.

Prior to the creation of Ornge Air there were 13 so-called Standing Agreement private sector air ambulance outfits working on behalf of Ornge. Today, five SA carriers support Ornge.

|

|

The balance of Air Bravo’s business comes from charters. These tend to be related to the movement of personnel and supplies associated with the exploration of natural resources and the maintenance of the infrastructure in Northern Ontario. Mining companies, telecommunications carriers, power utilities and governmental departments are typical charter customers. Key competitors for that business include Wasaya Airways and Private Air. Both of these Thunder Bay-based concerns operate PC-12s as well.

The plane

The workhorse of Air Bravo’s air ambulance operation is the Pilatus PC-12/45. Not only does it have a pressurized cabin that is ideally sized for medevac work, but its design and performance is well suited for the short gravel runways so often encountered at remote destinations. Furthermore, its single PT6-67B powerplant has proven to be reliable in all weather conditions and economical.

Once a PC-12 has flown 20,000 hours, a life extension program (LEP) has to be performed. This involves the aircraft being taken apart, thoroughly inspected, then reassembled. During the LEP, an aircraft can be out of service for six to eight months. According to Robert Arnone, president/CEO of Pilatus Centre Canada, the inspection typically costs $300,000. Depending on the amount of remedial work that is required on an aircraft, the total cost of an LEP could be double that figure. Two of Air Bravo’s nine PC-12s are currently undergoing LEP work at the Pilatus facility in Thunder Bay. A third aircraft is approaching that event as well. The good news is that once the LEP is completed the airframe will be good for another 30,000 hours.

Air Bravo is currently getting approximately 130 hours per month on each of its PC-12s. That is down from about 200 hours per month prior to the introduction of the Ornge Air fleet. That represents a 35 per cent decline in monthly utilization. That rate will likely get a bump while the higher-time PC-12s undergo their LEPs.

The team

Air Bravo’s headcount currently stands at 88. The roster includes 40 pilots, 25 paramedics, eight aircraft maintenance engineers, two in sales/marketing, five in administration and eight performing other duties. None of its employees is unionized.

The employee turnover rate is typical of an operator this size in this part of the country. Pilots have the highest rate, due to the traditional ambition of individuals to command ever larger machines. The medical personnel tend to have a medium rate of turnover, while the AMEs have the lowest rate.

About a quarter of its employees have been with the company for more than five years. Given the dynamics of the industry and the fact that the company is only a decade old, this is not unusual.

Horwath points out that the company’s growth and ongoing success is due to the skill and efforts of his entire team and specifically of his senior managers. Chris Reynolds is Air Bravo’s operations manager. He is the second in command and has participated in the company’s expansion during his nine years there. Rob St. Michel, the company’s director of maintenance, has also been a key contributor to the firm’s evolution during his nine-year tenure. Relatively new to the scene, is Phil Cook. As Chief Pilot, he is charged with keeping the flight decks occupied, thereby enabling the aircraft to be ready on short notice.

Excellent maintenance and skilled flight crews working together have resulted in an outstanding safety record at Air Bravo. That is supported by the fact that Air Bravo has received the Platinum rating from Argus International, the aviation safety auditors from Cincinnati, Ohio. Platinum is Argus’ highest level of quality rating and it’s only awarded to operators that have demonstrated successful implementation of industry best safety practices relative to their operations and maintenance. The rating is a useful accolade when it comes to bidding for air ambulance business, let alone charters.

S.W.O.T. analysis of Air Bravo

In order to better understand any business model and therefore appreciate how a company may fare in the future, it is useful to perform a S.W.O.T. analysis (Strengths, Weaknesses, Opportunities and Threats). Doing so with Air Bravo provides the following insights:

//// STRENGTHS

Constant demand

The air ambulance business has proven to be recession resistant.

Revenue diversification

In 2002, the company received almost all of its revenues from air ambulance flying. That ratio declined to 85/15 in 2003 and declined further to about 75/25 in 2008. Today, it stands at approximately 60/40, reflecting the impact of Ornge Air and the increased demand for charters.

Standardized fleet

Operating principally one type of aircraft provides savings with respect to rotable and parts inventories, maintenance and training costs.

//// WEAKNESSES

One significant customer

When one client represents more than half of a company’s top line, it focuses the management’s attention on providing a level of service that at least meets (and preferably exceeds) that customer’s expectations.

Uncertainty surrounding Ornge Air

Questions remain about the air ambulance administrator’s future. Will it become a larger competitor by expanding its fleet, or will it simply remain the competitor that it currently is?

//// Opportunities

Industry restructuring

Perhaps, in due course, a decision will be made to downsize Ornge Air’s fleet or to contract out all air ambulance flying to private operators, as had been the practice for decades.

Increased charters

With the long-term growth of Ontario’s economy should come increased demand for air charters in Northern Ontario. As a local operator, that is equipped with appropriate assets and has long-term relationships with established customers, the company stands to benefit from such activity.

Aircraft management

While the company only recently began participating in this niche market, future growth may be seen as more Northern Ontario based companies acquire aircraft. This would likely be a longer-term opportunity.

//// Threats

Ornge’s flight plan

Should it decide to increase the size of its own fleet, Ornge Air could put additional financial pressure on existing private sector operators that are already finding it a challenge to keep aircraft utilization rates at acceptable levels.

Economic downturn

Global metal prices are key to the amount of exploration and development activity carried out by mining companies in Northern Ontario. A weaker economy would also reduce the demand for non-resource oriented charter work within the province.

Summary

The creation of Ornge Air has meaningfully impacted the Ontario air ambulance industry. Its government-sponsored fleet has altered the competitive landscape dramatically. There has been a decline in the number of private-sector operators and some have seen a drop in the number of hours flown.

|

|

| Air Bravo’s PC-12s perform air ambulance missions as well as charters. PHOTO: AIR BRAVO

|

It appears, however, that the situation has stabilized. Horwath gives credit to Ron McKerlie, Ornge’s interim president and CEO, for a shift towards industry co-operation.

An example of this was Ornge’s mid-September launch of a six-month trial program of providing regularly scheduled air service, from Monday to Friday, between Sault Ste. Marie and Sudbury for patients with previously scheduled hospital treatment. Ornge contracted that flying out to Air Bravo, thereby making available its own aircraft for more urgent and emergency situations. When he announced the program last June, McKerlie noted that, “Our Standing Agreement carriers are valued partners in the delivery of air ambulance service and I look forward to working with them on this new initiative.” Echoing that sentiment, Horwath said, “We value our partnership with Ornge and welcome the opportunity for us to build on our existing relationships to help deliver an efficient and cost-effective air ambulance service for the benefit of the citizens of Ontario. By creating strong partnerships through our common goals, we can continue to find innovative ways to deliver our services.”

The key questions being posed by Ontario’s air ambulance operators relate to Ornge’s future operational strategy. Will Ornge continue to operate its own fleet of 20 aircraft? Will it expand that fleet? Or, will it decide to contract the operation of those aircraft to the private sector?

Key to the future: an agent of Ornge

Air Bravo’s contract with Ornge will be up for renewal on March 15, 2013. Horwath and his team recognize that the competitive environment will require the company to continue delivering the same level of service that it has during the past decade in order to win a renewal. Given its operational footprint and its safety record, Air Bravo appears to be well positioned to assist Ornge in meeting its mandate for years to come. With respect to his company’s future relationship with the provincial air ambulance overseer, Horwath said, “We look forward to working with the new Ornge and MOH with the hope of bringing the air ambulance system back to where it should be.”

In the meantime, the company continues to gradually diversify its revenue base by going after charters and aircraft management business. When asked what the Air Bravo fleet might look like in a decade, Horwath expects that the number of aircraft in service to double with the addition of more corporate aircraft, potentially including business jets.

The past 10 years have been extremely hectic for the team at Air Bravo. Given what may transpire during the next several years it looks like another exciting decade is in store.