Features

Aircraft manufacturers

Fifth Generation Build of the F-35 Lightning II

Lockheed Martin drives to provide the F-35 program with more operational readiness at less cost

April 14, 2020 By Jon Robinson

Lockheed Martin's F-35 production line in Fort Worth Texas produces all three variants of the fifth-generation fighter jet. (Photo: Alexander H Groves, Lockheed Martin)

Lockheed Martin's F-35 production line in Fort Worth Texas produces all three variants of the fifth-generation fighter jet. (Photo: Alexander H Groves, Lockheed Martin) Midway along the one-mile assembly line at Lockheed Martin Aeronautics’ F-35 Lightning II production facility in Dallas-Fort Worth, Kevin McCormick, business development lead for the program, points to a 50-inch hinge on a wing skin being manufactured for the carrier variant of the fifth-generation fighter. The designated F-35C model has foldable wingtips for storage on the hangar deck and to allow for two aircraft to be simultaneously brought up by elevator to the flight deck.

When not folded to 29-feet, the F-35C has a larger wingspan than the F-35A and F-35B variants – at 43-feet versus 35-feet, respectively – to generate maximum lift when coming off the end of the deck. The larger horizontal surface area of its wings also allows the F-35C to bleed off energy for arrested carrier landings. The F-35C also has the greatest internal fuel capacity of the three F-35 variants, carrying nearly 20,000 pounds of internal fuel for what the F-35 Joint Program Office (JPO) describes as longer range and better persistence than any other fighter in a combat configuration. The F-35 program is officially run by the JPO to coordinate multi-nation participation, with Lockheed Martin serving as the prime contractor.

Combining its range with the fifth-generation capabilities of stealth and sensor fusion common to the other two variants, JPO notes the F-35C will serve as the U.S. Navy’s future first-day-of-the-war strike fighter – unique in the world as a purpose-built carrier aircraft with very low observability never before deployed at sea. The U.S. Navy is the largest customer receiving F-35Cs, with the U.S. Marine Corps also acquiring the C variant in addition to the F-35B. The B variant is primarily defined by its lift-fan technology for vertical takeoff and landing.

McCormick makes note of a rectangular cutout on the lower wing skin for a B model, which is where some 2,000 pounds of hot gas will be vented off the core of the engine to assist in its short takeoff and vertical landing. Most of the wings – being built vertically to save space – are for the F-35A variant, because seven of the eight international partners and all four foreign military sales customers are currently buying the A-designated model.

“We have A models, B models and C models all coming off the same line and we do not have segregation between domestic or international. It is one of the big selling points here,” says McCormick. “We’ve been doing that for years on the F-16 and other products out of this facility.” Hinting at recent manufacturing advances at the plant, McCormick notes how quiet the production environment is, because, unlike with its previous build of F-16s, there are no rivets used on the F-35 – a key attribute of the aircraft’s very low observability capabilities.

The F-35A Lightning II Joint Strike Fighter variant is competing for Canada’s Future Fighter Capability Project (FFCP), which aims to procure 88 new generation fighters to replace the country’s ageing CF-188 Hornet fleet. The FFCP competition was launched in late-2017 and now has three aircraft under consideration, including the F-35A, Boeing F/A-18 Super Hornet, and Saab Gripen E.

Dassault and the consortium behind the Eurofighter Typhoon have pulled out of the competition with both noting Canada’s extensive interoperability requirements with U.S. forces as a primary reason, as well as the RFP’s Industrial Technological Benefits (ITB) obligations. Canada’s evaluation criteria for its Future Fighter procurement is based on technical merit (60 per cent), cost (20 per cent) and economic benefits (20 per cent). In February 2020, the federal government announced it would extend the FFCP submission deadline from March 30 to June 30, but maintained its schedule to choose the winning bid in 2022 and have the first aircraft delivered by 2025.

The 20 per cent weighting toward economic benefits is ultimately defined by dollar-for-dollar obligations – meaning, the fighter supplier provides Canadian companies with revenue opportunities equal to value of the purchased aircraft. Technical merit weighting includes interoperability requirements with NORAD. This would naturally seem to provide more opportunity for U.S.-built fighters to win the contract, but all three of the remaining competitors face past political encumberments tied directly to aerospace business.

Without wading too deep into the political motivations behind what will be an investment of more than $20 billion dollars, there are a clearly a number of reasons why the Trudeau government would support the procurement of the F-35 based on the three pillars of weighted criteria, cost, economic benefit and technical merit.

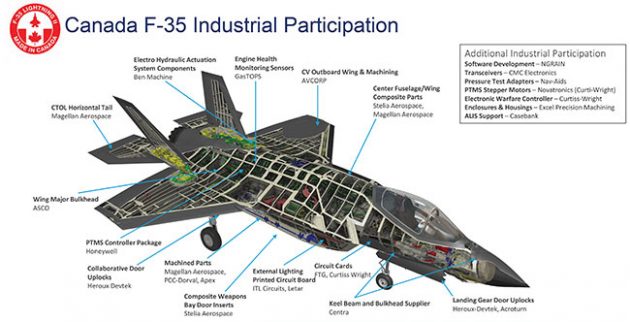

Canada became an industrial partner of the F-35 Joint Strike Fighter Program in 1997 and there are now more than 110 Canadian companies contributing to the production of the F-35 program, which equates to thousands of jobs and what Lockheed estimates to be more than $1.5 billion in terms of contract value over the life of the program. This includes that 50-inch hinge for the F-35C wing, which was procured from a Canadian company.

McCormick points to the monitors sitting above the aircraft sections being working on in a staging area, which identifies where the JPO is at in terms of the worldwide delivery sequence of F-35s. He notes aircraft number 664 is bound for Australia and next to it is aircraft number 665, which will go to the Marines. More than 455 F-35s had been delivered to customers by November 2019 with the aircraft in operation at 20 bases around the world. (By early 2020, Lockheed announced more than 500 F-35s had been delivered to customers.)

The F-35 JPO goal is to deliver 80 per cent mission capable rates in the near term, and achieve a $25,000 cost per flight hour by 2025. (Photo: Lockheed Martin)

In late November, the Lockheed Martin Aeronautics facility in Dallas-Fort Worth was producing lots 11 and 12, which the company also refers to as LRIP 11 and LRIP 12. LRIP stands for Low Rate Initial Production and each lot identifies with when a contract is first awarded. LRIP 11, for example, was contracted in 2017 and those aircraft were being delivered throughout 2019. This lot timing is significant because it ultimately determines the price of each fighter jet for new contracts. If Canada is to name the F-35 as the winning bid, it would likely receive LRIP 15 aircraft, or perhaps from LRIP 16 given the new RFP extension.

As a clean-sheet, fifth-generation fighter, which is primarily defined by stealth and sensor fusion, the initial cost of the LRIP 1 F-35A fighters was just under $250 million per unit (all remaining dollar amounts are presented in U.S. funds). It was not until LRIP 5 when the first nine F-35s were delivered to external customers at a cost of around $125 million per unit.

“We set a target, that by lot 14, LRIP 14, we would get to an $80 million jet. Some folks said it was unattainable but we have reached it a year early. LRIP 13 will be less than $80 million for an A,” says Mike Shoemaker, vice president, customer initiatives at Lockheed Martin Aeronautics. Lockheed estimates the average price for the F-35A will be $79.2 million in LRIP 13 and $77.9 million in LRIP 14.

Shoemaker joined Lockheed a year and a half ago after a distinguished 35-year military career, retiring in 2018 as Vice Admiral of the U.S. Navy. Serving as Commander of Naval Air Forces, he was responsible for the combat readiness of all Navy Aviation forces and 11 nuclear-powered aircraft carriers – 82,000 personnel, 168 squadrons, 2,800 aircraft and a $7.5 billion annual operating budget. He has also accumulated more than 4,400 flight hours, primarily in the A-7E Corsair and F/A-18C Hornet, with 1,066 carrier-arrested landings.

In his new role with Lockheed, Shoemaker is the customer interface for Aeronautics product lines and services, predominantly for the F-35 program, ensuring that the company meets strategic milestones and satisfies both international customer and industrial partner requirements. “We’ve been successful in the cost piece of the program… 77 per cent of the cost of the airplane is in the parts. We’ve been very aggressive and working with partners, trying to get them on long-term contracts, incentivizing them to reduce the costs of the parts that make up the F-35,” says Shoemaker, who also points to cost savings coming from what the company refers to as touch labour. “We’ve had a 75 per cent reduction in touch labour on this airplane since 2010.”

LRIP 13 production will represent a 70 per cent decrease in per-unit cost since LRIP 1. Driven by an increase in assembly-line automation for the F-35, the Lockheed Martin Aeronautics facility has essentially doubled its production from 2017, when 66 aircraft were delivered, before reaching 91 aircraft produced in 2018, and holding to its target of 131 aircraft to be delivered by the end 2019.

Lockheed Martin expects that by the end of 2022, the F-35 will reach nearly 30 bases with more than 860 aircraft delivered. Eight services, including the U.S. Air Force, U.S. Navy, and U.S. Marine Corps, have reached Initial Operational Capability with the F-35. This has resulted in more than 230,000 flying hours for the F-35, with more than 955 trained pilots and more than 8,475 qualified maintenance personnel. Luke Air Force Base in Glendale, Arizona, on February 21, 2020, achieved a major milestone by completing more than 56,000 F-35 flight hours. Canadian pilots would train at Luke if the F-35A Lightning II wins the country’s FFCP.

“This really highlights the opportunities to be part of a growing worldwide fleet, 3,500 to 4,000 aircraft,” says Shoemaker, alluding to the potential for the F-35 to not only satisfy Canada’s FFCP technical requirements with an interoperable, true fifth-generation fighter, but also satisfy Industrial Technological Benefits obligations under the RFP. Lockheed Martin CEO Marillyn Hewson pegged the F-35 fleet number at 4,000 during the 2019 Paris Air Show. “We may go beyond that. If you look at the number of F-16s we delivered as sort of the de facto NATO fighter years ago, we may replace them with F-35s, but I think the opportunities for a growing worldwide fleet are huge and certainly Canada has been an important part of the production piece so far.”

More than 110 Canadian companies contribute to the development and production if the F-35, which ultimately means more than $2.1 million worth of Canadian-built components are on every F-35.

Shoemaker also notes Canada would have a distinct advantage over other international partners of the F-35 program because the largest F-35 fleet will always be just south of its border. This will include an unprecedented 300 F-35s being delivered to the U.S. National Guard – the first time it is receiving brand new fighters off the production line. Japan currently holds the largest international F-35 fleet with a commitment for 147 jets. Poland recently committed to 32 F-35s and the JPO continues to be involved in Finland and Switzerland procurement competitions.

“What we’re doing here with the F-35 is building a unified fleet,” says Steve Sheehy, director, sustainment strategies and campaigns, Lockheed Martin. “This is a single point of view. We’re pulling all the sustainment data together for that entire fleet, roughly 4,000 aircraft.” Sheehy has been involved in F-35 international logistics program management for more than four years. He is a former Colonel in the U.S. Air Force, where he spent 25 years in a range of maintenance and logistics roles for military aircraft like the F-15, F-16, U-2, RQ-4 and MC-12. In comparing the fleet position of the F-35 with the F-16, he notes the latter airplane has 28 independent fleets being served by 24 different supply chains.

“The F-35 is engineered for sustainment,” he says. “The analytics and data we pull off this jet will allow us to drive to what we call a condition-based maintenance philosophy. We are able to predict what parts are about to fail.” Sheehy explains this predictive health analysis has been a significant factor in helping to drive up Mission Capable (MC) rates for the F-35. The company has a target of reaching an MC of 80 per cent, assuming the remaining 20 per cent will be equally accounted for by non-mission capable maintenance and supply. Sheehy notes the fleet is already seeing many operational cases of customers exceeding an MC of 80 per cent, particularly with the F-35A variant. “It’s also about the R&M of the components of this aircraft. To date, 73 per cent of the parts of the aircraft have not failed. That’s a huge testament to our suppliers.”

In terms of cost per hour, Lockheed Martin states it is targeting the generally accepted rate of $25,000 for a fourth-generation fighter. The JPO recently noted an F-35 rate of around $36,000 per flight hour. The Lockheed team sees this hourly rate trending in the right direction and expects its fifth-generation F-35A to reach $25,000 per hour flight time by 2025. To this end, the government initially asked Lockheed to develop processes that would result in nine maintenance hours per flight hour, but the team has already achieved six maintenance hours per flight hour.

Sheehy describes a range of initiatives that are providing signficiant sustainment cost reductions for the F-35. To a point where the traditional flightline maintenance teams have adopted the term BOLT – Blended Operational Lightning Technician, because they are no longer working in task silos.

A primary tool of cost reduction is the legacy Autonomic Logistics Information System (ALIS), which is now being updated a new generation. Described as a portable maintenance aid, ALIS is the centrepiece of maintenance tasks and, therefore, operational capability for the F-35. With ALIS running an APU, which eliminates the need to start up the F-35’s powerful Pratt & Whitney engine, and an Integrator Power Package, maintainers are able to work on all F-35 systems from a laptop – with full visibility inside the aircraft control systems, weapons systems and fuel systems.

Leveraging ALIS, a crew chief with a laptop can actually transfer or check the condition of the entire fuel system and quantities per fuel tank, which alone changes the need for six people to just one. Sheehy also points to the how the F-35 uses pneumatics (air pressure) to release armaments from the weapons bay, as opposed to traditional explosive shells, which saves manhours in terms of cleaning carbon out of the systems.

“On the F-35, 95 per cent of our line replaceable units are what we call first-tier removable. There’s nothing in front of them to stop them from being taken out,” explains Sheehy, describing yet another massive manpower reduction provided by the F-35 design. He also notes the F-35 uses six flight control systems driven by independent, self-contained Electro Hydrostatic Actuators (EHAs). “With a single button, in less than a minute, the flight controls on the aircraft are rigged. No one else can do that. Those six EHAs systems are all electronically tied together.”

The F-35 also eliminates traditional steps of legacy fighters in pulling out critical computing hardware. The Communications, Navigation and Identification (CNI) system on the F-35 is actually stored on racks easily accessible from the outside of the aircraft, allowing for single-item swap outs. This again saves maintenance hours, but more importantly also protects the aircraft’s low observability (LO) platform.

“On our aircraft, 86 per cent of the parts you need to get to are behind panels that require no LO restoration,” says Sheehy. “With other stealth aircraft, if you took off a panel on the aircraft, you had hours to restore the LO edges for that panel… There is no LO restoration required at all [on the F-35].” He explains the government asked for nine flight hours between LO maintenance events, but F-35 maintenance teams are now averaging 17 hours before they need to touch the LO system.

Before heading over to the coating facility where the F-35 comes to life in its final stealth skin, McCormick finds an in-production F-35 that is destined for Norway, sitting in a main airframe fixture, where a jet typically stays for 45 days. “Okay – right here, the attach point will be on the aft portion, as well as on the wing’s centre barrel,” he explains, accommodating a request to find a feature that would likely be added to a Canadian F-35 contract. “That is where the doghouse faring for the drag chute will go, as well as the hydraulics that are already plumbed in… the Norwegians opted for the drag chute to slow the aircraft down in icy runway conditions.”