News

Airlines

Chorus Aviation reports Q2, aircraft leasing growth continues

August 13, 2019 By Wings Staff

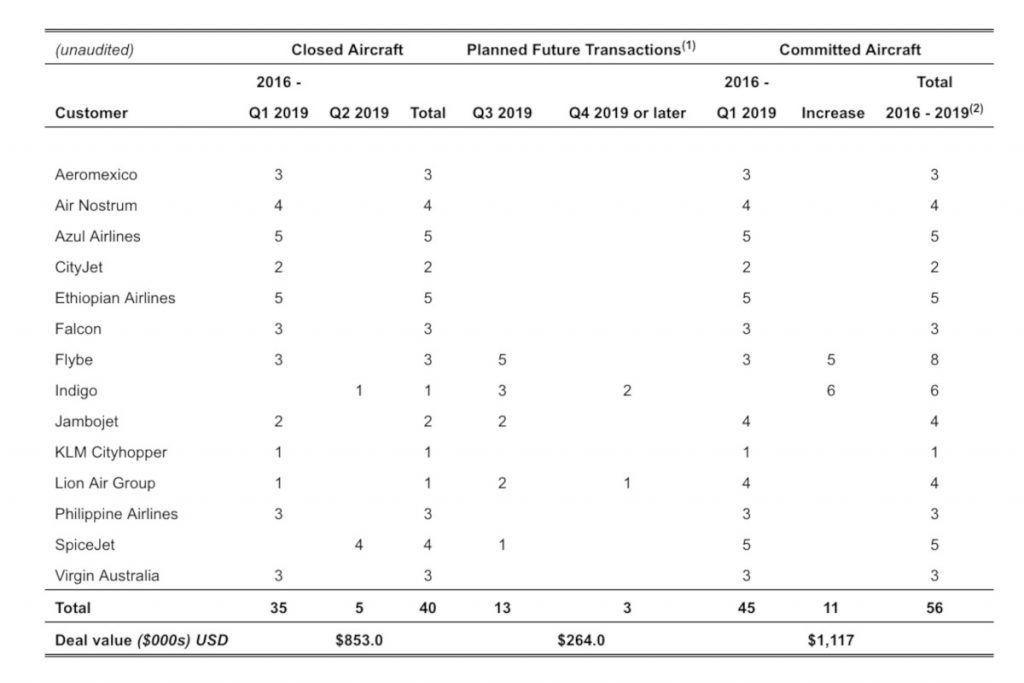

Closed and pending transactions for the Chorus Aviation Capital’s Regional Aircraft Leasing segment. (Chart: Chorus Aviation)

Closed and pending transactions for the Chorus Aviation Capital’s Regional Aircraft Leasing segment. (Chart: Chorus Aviation) Chorus Aviation Inc. today published its second quarter 2019 financial results with a net income of $38.9 million, an increase of $22.6 million relative to the corresponding period of 2018, which includes an unrealized foreign exchange gain of $16.1 million. Adjusted net income for the quarter, however, came in at $24.7 million, representing a decrease of $4.9 million or 16.5 per cent relative to the second quarter of 2018.

The adjusted net income decline, according to Chorus, is based on a number factors, including: an increase in depreciation of $4.2 million and interest costs of $4.5 million related to additional aircraft in its Regional Aircraft Leasing segment; an increase in other costs of $2.2 million related to foreign exchange losses on working capital; a $1.6 million increase in adjusted EBITDA previously described; and a $4.4 million decrease in income tax expense related to lower adjusted EBT.

Chorus’ Regional Aircraft Leasing fleet commitments grew to 56 aircraft valued at US$1.1 billion (based on agreed lease rates) with future contracted leasing revenue of approximately US$815.0 million. “I’m immensely pleased with our performance in the second quarter and particularly with the traction we’re gaining in the regional aircraft leasing space, having announced commitments on 11 additional aircraft in the period,” said Joe Randell, president and CEO, Chorus.

The company’s leasing arm, Chorus Aviation Capital, was launched in early 2017. Among its portfolio of 56 aircraft,13 are expected to be delivered in the third quarter and two in the fourth quarter, with the remaining aircraft by the end of 2020. When combined with the aircraft lease commitments under the recently Capacity Purchase Agreement involving Air Canada, Randell explains the company’s fleet of leased aircraft reaches a value of over US$2.0 billion with US$2.0 billion in future contracted lease revenue.

Chorus, Air Canada complete Capacity Purchase Agreement

“We had earlier communicated our intention to commit our leasing growth capital by early 2020 and I am pleased to report we have delivered on this milestone almost a full year in advance – a strong indicator of the opportunities that exist in this sector,” said Randell. “Since the launch of the business, we have grown the regional aircraft leasing segment by an average of approximately 20 aircraft per year.”

In the second quarter of 2019, Chorus reported adjusted EBITDA of $85.7 million, an increase of $1.6 million or 1.9 per cent relative to the second quarter of 2018. The Regional Aircraft Leasing segment’s adjusted EBITDA increased by $10.4 million, which Chorus explains is due to the growth in aircraft earning leasing revenue.

Looking at the first six months of its fiscal year, Chorus reported adjusted EBITDA of $160.4 million, a decrease of $1.2 million over the 2018 period. The Regional Aviation Leasing segment’s adjusted EBITDA increased by $16.9 million, again due to the growth in aircraft earning leasing revenue.

Year-to-date adjusted net income was $43.7 million, a decrease from 2018 of $12.5 million or 22.2 per cent, which the company states is due to the $1.2 million decrease in adjusted EBITDA previously described, as well as depreciation, interest and tax costs, and foreign exchange losses. Year-to-date net income was $72.4 million, an increase of $50.8 million over the 2018 period, which again primarily relates to gains in unrealized foreign exchange gains on long-term debt.

Print this page