Features

Operations

A bright light

At the launch of any enterprise, a company’s business plan typically defines its purpose, outlines how it will attract customers and generate revenues

September 13, 2012 By Frederick K. Larkin

At the launch of any enterprise, a company’s business plan typically defines its purpose, outlines how it will attract customers and generate revenues, offers detailed cash flow forecasts and assumptions and provides estimates of future financing requirements.

|

|

| Aurora Jet Partners provides air charters, offers aircraft management services and operates a fractional ownership program. Its new FBO at Edmonton International Airport has just joined the Signature Flight Support family of more than 100 FBOs around the globe. Photo: Morningstar Group

|

Despite the best efforts, however, often market conditions shift. Sometimes what made sense in the start-up stage doesn’t any longer – the strategic vision changes in order for the company to survive, or because more attractive opportunities become available. When this occurs, creative thinking is required to keep the corporation headed towards prosperity.

Such nimble helmsmanship has enabled one Alberta-based aviation company to deviate around economic storms and climb above financial headwinds for more than 40 years. Morningstar began with a pair of tiny Cessnas, and then became a dealer. It later transitioned into a charter operation using light piston twins, added small turbine aircraft to support courier companies and eventually developed an all-cargo jet airline. In recent years, it has returned to its general aviation roots with the creation of a division that manages and charters business jets as well as an expansive fixed-based operation (FBO) facility.

Given the turbulent state of the global economy, is Morningstar positioned to achieve stable growth or will its enviable longevity be challenged? Before attempting to answer this, it’s useful to review how the company has evolved over the past four decades.

That was then . . .

The company began during the summer of 1970, when Brooker-Wheaton Aviation Ltd. was founded at Edmonton Industrial Airport by businessmen Dr. Bev Brooker and Donald H. Wheaton. Their first two aircraft, a Cessna 150L (CF-AZN) and a Cessna 172L (CF-CKS), came directly from the factory in Wichita, Kan.

Alberta’s vibrant economy provided lift for the small outfit and it grew into an FBO that later became a Cessna dealer at the downtown airport. The fleet expanded to include 300- and 400-series twin-Cessnas, Piper Cheyennes, Beech King Airs and eventually 20- and 30-series Learjets that were used for charters.

During the early 1980s, Don Wheaton bought out Dr. Brooker and became the company’s sole owner.

|

|

| Edmonton’s newest FBO location was showcased in style this past June with an elaborate open house that gave guests a chance to test-drive several immaculate high-end sports cars. Photo: Morningstar group

|

Brooker-Wheaton’s fleet became exclusively turbine-powered and it diversified into the aircraft leasing business. Not long after, it began operating for a number of courier companies using Swearingen Metros and Cessna 208 Cargomasters.

In early 1990, B-WA won the right to operate domestic flights on behalf of Federal Express Canada Ltd. and initiated service with Cessna 208s in February 1990. In July 1990, its contract with FedEx was expanded to include the operation of a pair of Boeing 727-100Cs. That fall, the firm began flying a Toronto-Winnipeg-Calgary-Vancouver routing in both directions. By the end of 1991, B-WA was using a trio of the tri-jets, a pair of Fokker F-27 Mk.600s and half a dozen Cargomasters for FedEx. At the same time, the company had enhanced its corporate charter fleet to include a pair of King Airs, a Learjet 35 and a Canadair Challenger 600S.

In January 1992, Kim Ward (a son of Canada’s Aviation Hall of Fame member Maxwell W. Ward) purchased half of the company and it was renamed Morningstar Air Express Inc. “Marjorie Morningstar” was the pet name given to Kim Ward’s mother by his father, Max. Donald A. Wheaton, a son of co-founder D.H. Wheaton, also joined the company’s board of directors.

Over the following decade, the Morningstar fleet continued to evolve. The two F-27s were returned to their lessors in late 1993, a fourth 727-100C was added in the spring of 1995, the Lear 35 was replaced by an HS-125-700A in mid-1995 and the last King Air was sold by the end of 1996. In 1998, the Metro wet lease contract with FedEx was cancelled and replaced with two leased Cessna 208Bs in Vancouver and Montreal.

As cargo traffic continued to grow, so did the need for greater lift. In 2004, the Boeing 727-100Cs were replaced with larger 727-200Fs. By March 2008, the company had five 727-200Fs, an ATR42-300 freighter and the six Cessna 208Bs operating for FedEx across Canada.

Morningstar’s contracts with FedEx have traditionally been five years or less, but in 2009 it won a request for proposal (RFP) on a longer-term contract from FedEx. Not long after, it once again began upgrading its Boeing fleet. Two 757-200 freighters arrived in July 2010, followed by a third that October. The last two 727-200Fs departed the fleet in February 2011 and were replaced by an additional pair of 757-200s. The 757s could carry 80,000 lbs. in 14 pallets, compared with 58,000 lbs. in 11 pallets aboard the 727-200Fs. That represented a 38 per cent increase in capacity.

While the cargo operation was continuing to grow, the company had not overlooked its other niche activity – corporate aviation. Morningstar Partners Ltd. was created in mid-2007 to provide a fractional ownership program (FOP) for clients in Western Canada. By the end of that year, its fleet consisted of a pair of Hawker 900XPs and a Bombardier Challenger 604.

An expanding footprint

Today, the Morningstar group includes interests in three companies: Morningstar Air Express Inc., Morningstar Partners Ltd. and Airside Properties Inc. Here’s a breakdown of each aspect of the operation.

Morningstar Air Express

As the provider of domestic lift for Federal Express Canada Ltd., Morningstar operates five Boeing 757-200s, seven Cessna 208B Super Cargomasters and one ATR42-300. All 13 aircraft are leased and wear FedEx’s distinctive white, purple and orange livery. Every weeknight, while most of the country is asleep, the 757s fly back and forth between Vancouver and Halifax, stopping at almost every major city in between.

The Cessna 208Bs, based at Vancouver, Winnipeg and Toronto, feed traffic to/from Victoria, Thunder Bay, Timmins, Sault Ste. Marie, North Bay and Sudbury. The sole ATR42 is dedicated to the Montreal (YMX)-Quebec route. While FedEx personnel look after the ground handling duties at all the stations, Morningstar crews handle all aspects of the flight operations.

Morningstar Air Express is owned 50 per cent by each of Don Wheaton Ltd. (represented by Don A. Wheaton) and Interward Capital Corporation (represented by Kim Ward).

Morningstar Partners

Doing business as Aurora Jet Partners, this company provides air charters, aircraft management services and operates a fractional ownership program. In addition to ad hoc charters, charter time is also available in blocks of 25 or 50 hours for frequent travellers who don’t wish to purchase part of an aircraft. For those companies and individuals who require more air time and want to regularly fly aboard the same type of aircraft, the company sells interests in its aircraft ranging from a 1/8 share (100 hours of annual flight time) to a 1/2 share (400 hours). For aircraft owners that do not want to establish their own flight department, Aurora will look after matters related to flight crews, maintenance, hangarage, scheduling, catering, insurance and administration.

The company’s fleet currently includes two Embraer Phenom 100s, one Embraer Phenom 300, two Hawker 900XPs and one Bombardier Challenger 605.

Morningstar Partners is owned 25 per cent by each of Don Wheaton Ltd., Interward Capital Corporation, Ledcor IP Holdings Ltd. of Vancouver and a private investor from Edmonton.

Airside Properties

With the pending closure of Edmonton City Centre Airport, the city’s business aviation hub will be relocating 18 miles south to Edmonton International Airport. In anticipation of that, Morningstar has participated in the establishment of a multi-use facility on seven acres of leased land at CYEG. The recently completed $25 million first phase of the project features four 20,000 sq. ft. hangar bays plus 25,000 sq. ft. of space for flight department offices and an impressive FBO terminal. Phase two of the development will have approximately 100,000 sq. ft. of additional hangar space in three bays and another 15,000 sq. ft. for training facilities and administrative offices. Airside Properties is owned 33.3 per cent by each of Morningstar Partners Ltd., York Realty Inc. and the Sawridge Group of Companies, all of Edmonton.

The crew

An integral part of any corporation is its workforce. Morningstar’s team may be compact, but it is productive. Its 159 employees include 80 pilots, 35 mechanics and 44 others who serve roles in operations, marketing and administration. The Morningstar Air Express pilots are the only unionized employees within the group.

The contract with the Canadian Auto Workers is a long-term deal that has an automatic renewal clause in March 2015 that ensures an agreement is negotiated without the need for economic sanctions against each other. Morningstar also employs an internal committee system, consisting of employees and managers, called Team Resolution and Issue Management (TRIM). TRIM’s purpose is to deal with personnel issues throughout the agreement in order to minimize the need for grievances and to keep the relationship open and strong. It does so by meeting once per quarter.

S.W.O.T. analysis of Morningstar

In order to achieve a better understanding of any business model and therefore to appreciate how a company may perform in the future, it is useful to perform a S.W.O.T. analysis (strengths, weaknesses, opportunities and threats). Doing so with Morningstar provides the following insights:

//// STRENGTHS

Impressive record of financial discipline

The company has survived more than four decades in an industry not known to be forgiving. Today, its two primary businesses employ a model that reduces exposure to variable expenses that are extremely difficult to forecast. On the fractional side, unpredictable costs related to fuel prices and repositioning flights are ultimately borne by the consumers and do not impact the company’s bottom line. Nonetheless, the need to optimize operating efficiencies never ends. A failure to do so would likely damage the healthy relationships with its customers that have been cultivated over many years in both businesses.

Constructive corporate culture

From the owners on down through management to the line workers, attention is paid to providing a level of service that surpasses the clients’ expectations. At the same time efforts are made to foster an atmosphere of professionalism and respect amongst the workforce. The net result is a low level of employee turnover. The average tenure is more than 10 years and many employees have been with the company for more than 20 years.

//// WEAKNESSES

One dominant customer

Federal Express Canada is the sole source of revenue for Morningstar Air Express and it represents a significant portion of the group’s total sales. Morningstar has served FedEx for 23 years and has several years left on its current contract. Any change in this long-running relationship would likely only come with a significant shift in the level of service provided or prices charged by Morningstar and/or a material change in FedEx’s own financial condition.

The traditional – Fractional Ownership Program model

The linear distribution of Canada’s population works against the traditional FOP model. A typical FOP operator’s profit can be significantly reduced by costs related to repositioning flights. Fortunately, Aurora’s FOP model is a hybrid that uses attributes of a traditional fractional ownership program as well as those of a typical aircraft management model. The result is a pricing structure that is both transparent to the clients/fractional owners and allows the operator to make money by using a “cost plus” formula. Cost certainty is a key tenet held by Aurora’s management that is much appreciated by its customers.

//// Opportunities

Gradual expansion of the cargo carrier

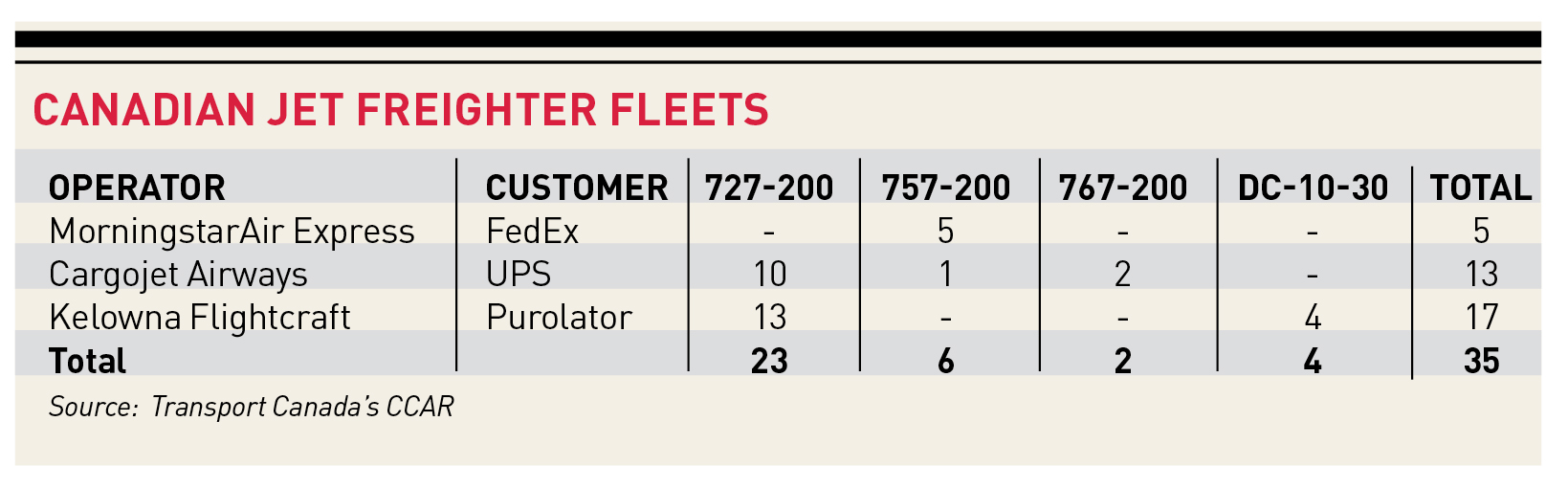

Given the current state of most of the G8 economies, it is somewhat reassuring to see that Canada’s is forecast to grow by at least two per cent this year and next. Slow but steady growth may not please everyone, but it has proven to be good for Morningstar Air Express. During the past two decades, it has upgauged its jet equipment twice. Some industry observers have suggested that there is excess cargo capacity within Canada. Of the three carriers that provide domestic lift for the three largest courier companies, Morningstar has the smallest fleet (see accompanying table). Perhaps there will eventually be some consolidation within the industry. In the meantime, Morningstar is prepared to provide more capacity for FedEx if and when it may be required and is also open to other market opportunities as they arise.

Aurora Jet Partners’

fleet expansion

For each of its three activities (aircraft management, fractional ownership and charters), the company expects to see the number of aircraft in service increase. Today, its six aircraft represent 30 shares held by 21 owners. Aurora was the first Canadian operator of both a Phenom 100 and a Phenom 300. It will be receiving its second Phenom 300 early next year. In addition, the company expects to have the first of two Bombardier Challenger 300s in service this fall and is due to take delivery of a new Bombardier Global 5000 in June 2013. In 10 years, the company is planning to operate a fleet of 30 managed and fractionally-owned jets.

Aircraft maintenance

Having maintained its own fleet of Boeing narrowbody airliners, turboprops and corporate jets during the past 20 years, Morningstar is considering that activity as a new source of stand-alone revenues. It will have room to do so in the new complex at YEG. In addition, it leases 14,000 sq. ft. of hangar space at Vancouver and 35,000 sq. ft. of hangar space at Calgary that is currently used for maintenance on its Boeings, Cessnas and bizjets.

Edmonton’s newest FBO

With an expansive new terminal that resembles the steel-and-glass palaces operated by Skyservice at Toronto and by Starlink at Montreal, Aurora’s new FBO at Edmonton International is positioned to house local flight departments forced to vacate YXD, as well as to welcome itinerant traffic. The company recently announced that its new facility will be the newest member of the Signature Flight Support family of more than 100 FBOs around the globe.

//// Threats

Cabotage

Should U.S. cargo carriers ever be allowed to operate within Canada, there would likely be an impact on Morningstar Air Express. To what degree is difficult to estimate. Since FedEx already operates all of its trans-border flights, it might choose to continue to have the Canadian domestic flights operated by a contractor such as Morningstar.

Higher costs

In both its air express and corporate aviation activities, Morningstar has customers that demand excellent service on a consistent basis at a reasonable price. This requires constant attention to detail and a close eye on service and operating costs.

Weaker economy

Significantly lower crude oil prices over a prolonged period, fallout from a European crisis or another North American economic downturn could result in dampened demand for both its freight and business aviation services.

Will the sun shine on Morningstar?

The risk reduction model in the freight business and the cost-plus model employed by the fractional business meaningfully reduces concerns related to volatile jet fuel prices and the amount of deadhead flight time. This allows its management team to focus on operating efficiencies and delivering quality services that retain current customers and attract new ones.

|

|

| With an expansive new terminal that resembles the steel and glass palaces operated by Skyservice at Toronto and by Starlink at Montreal, Aurora’s new FBO at Edmonton International is positioned to house local flight departments forced to vacate YXD. Photo: Morningstar group

|

Sourcing and retaining capable people is a challenge for any company, despite what unemployment rates may imply about labour availability. Morningstar’s low personnel turnover reflects well on the company’s culture. It also serves to moderate training costs.

The fact that Morningstar’s latest contract with FedEx is of a long-term nature speaks volumes about that customer’s past experience, as well as its expectations for the future. If the same level of service persists, all should go well for both parties.

The Canadian corporate jet charter and the aircraft management businesses are established models that tend to serve customers that require fewer than 50 hours or more than 400 hours of annual flight time, respectively. A potentially sizable market lies in between that is ideal for the fractional ownership program.

Enthusiasm for that can be muted, given the fact that profitability has been elusive for many FOP operators because of the amount of non-revenue flying that is performed, but Aurora seems to have an innovative model that fairly distributes this expense between its clients.

For every hour of revenue flight time, Aurora averages close to 20 minutes of repositioning flight time. For example, last year its Challenger 605 logged approximately 750 hours carrying passengers. About another 225 hours were attributed to ferry flights, resulting in full-year utilization of roughly 975 hours. The fees charged by Aurora for passenger flight time include the costs of repositioning aircraft. Aurora also uses a software program that posts all positioning flights for owners to see. The owners are able to take advantage of those flights, on any of the aircraft within the fleet, free of charge without using up any of their allocated hours.

While Morningstar’s activities may not experience rapid growth going forward, that is probably not a bad thing. Many outfits have seemingly been blessed with fast growth, only to see their businesses founder for a variety of operational and financial reasons.

Can FOPs work in Canada?

The fractional ownership concept was created in the U.S. when Executive Jet Aviation Inc. of Columbus, Ohio introduced its NetJets program in 1986. Since then, the business has grown dramatically with the largest five FOPs currently utilizing almost 800 aircraft. NetJets dominates the industry, with a fleet of approximately 550 aircraft comprised of 12 different types. The second largest FOP, Flexjet, operates about 80 jets including five models.

|

|

| As the provider of domestic lift for Federal Express Canada Ltd., Morningstar operates five Boeing 757-200s, seven Cessna 208B Super Cargomasters and one ATR42-300. Photo: Morningstar group |

U.S. fractional operators serve a domestic market that is broadly distributed. With Boston, Miami, Los Angeles and Seattle in the “corners” and many populous points in between, the American market is spread out on a grid. This explains why at any time a large FOP’s fleet can be located all over the map – literally.

These facts highlight the two defining differences between the U.S. and the Canadian markets: scale and distribution. Not only is Canada’s population approximately one-tenth the size of its southern neighbour, its distribution pattern is unique. Many of its key business centres (including Vancouver, Calgary, Regina, Winnipeg, Toronto, Montreal and Halifax) are laid out like a string of pearls along the 49th parallel. In addition, about 50 per cent of Canada’s population is located within a 700-mile corridor from Windsor to Quebec City. The market’s geographic distribution is extremely important to any FOP operator because of the need to constantly reposition aircraft for their next missions. These non-revenue flights are a necessary evil in the traditional FOP model. Conversely, with a fully owned aircraft, its owner has to either house the crew and park the aircraft while on an extended visit, or send the jet back to its home base empty.

Another important issue is the fact that a significant portion of Canadian corporate jet air time is spent flying south/north. Unfortunately, cabotage-related regulations restrict the use of commercially operated Canadian bizjets between any two points within the U.S. The same holds true for U.S. carriers in Canada. However, the Canadian Fractional Private Operator Certificate program allows a Canadian fractional owner to fly point-to-point within the U.S. – just as a fully owned Canadian private aircraft can.

Given the smaller size and the linear distribution of Canada’s market, as well as the U.S. cabotage restrictions, the traditional FOP business model continues to face some resistance in Canada. That may explain why there isn’t one truly national FOP operator that has clients from Victoria to St. John’s. Instead, there are a number of regional operators that serve the largest cities across the country.

Could there ever be a trans-Canada fractional program with a fleet of 50 jets? Possibly, but probably only with a modified version of the traditional business model. Bill McGoey, Morningstar’s president, envisions the creation of a “pooling membership” whose participants would be corporate jet owners from across the country. The idea would be to make optimal use of aircraft by making them available to members through the administration of an aircraft utilization credit trading system associated with subscription/membership fees. That way long-distance non-revenue repositioning flights could become less frequent by being shared or offered to members who may be in the vicinity to take advantage of a member’s jet.

The largest Canadian business aircraft management companies have stayed clear of FOPs because of the aforementioned issues. Perhaps a co-operative effort by those companies and their clients could be the foundation of a truly national fractional ownership program – not simply a charter network. Many of these firms operate FBOs that have passenger terminals and hangars in Vancouver, Calgary, Edmonton, Toronto and Montreal. Key issues such as the types of aircraft to be used, standards related to the age of the equipment and the experience of flight crews, as well as the responsibility for scheduling, marketing, pricing and administration, not to mention regulatory matters, would have to be dealt with.

Does McGoey believe that there might be an interest amongst Canadian aircraft management companies in creating such a program? “I am convinced it is a visionary idea that if executed effectively would be industry-changing, but execution does have serious challenges to be overcome,” he said. “However, I believe that the industry and participant benefits outweigh these challenges.”

|

A final thought

When asked what Morningstar’s successful track record can be attributed to, McGoey said, “I credit our ownership group, Don Wheaton and Kim Ward, for our longevity.” He notes that they bring key ingredients for success to the table, including “financial strength,” a “passion for aviation spanning generations of family involvement,” a “heartfelt commitment to our employees” and an appreciation for the need to “nurture customer relationships.”

Where does McGoey see the company in 10 years time? “My long-term vision for the company is to build Morningstar into a diversified aviation portfolio that owns and operates industry-leading and specifically-focused aviation services.”

A long-distance flight sometimes requires numerous course changes in order to reach its destination without incident. The same can be said about the long-term management of a corporation. For 42 years, Morningstar has modified its businesses to meet the changing needs of its customers and remain viable. In the process, it has become a respected operator in the transport of time-sensitive individuals and packages. Befitting its name, Morningstar appears to be well placed to remain a bright light in the sky over Canada.